Contents

This is unusual as you cannot physically hold fractions of one cent but this is a common feature of the foreign exchange market. It is also essential to know the markets well and, of course, to comprehend how to read different currency pairs to correctly interpret the quotes in the Forex market. Forex trading involves the constant purchase and sale of currency.

If you find these terms initially confusing, it helps to remember that the terms bid and ask are from the broker’s perspective, not yours. When you’re buying, you’ll pay what the broker’s asking for the currency; when you’re selling, you’ll need to accept what the broker’s bidding. The same approach is used to read to any other currency pair with a quote price. Exotics Exotics are expensive to buy and sell, and few traders speculate on these. All in all, nothing should forbid traders from adding the exotics to their portfolios.

Forex.Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Forex Academy is among the trading communities’ largest online sources for news, reviews, and analysis on currencies, cryptocurrencies, commodities, metals, and indices. If you’ve ever tried to demo trade, you’ll find out that your trades are always starting out on the negative. As soon as you click that “Buy” or “Sell” button, you’re already on the negative.

Candlesticks Chart

Few people play new online games without understanding how they work, right? However, most traders often forget to acquaint themselves with currency pairs they wish to buy or sell in the forex market. While trading currency is of course different from playing interactive brokers forex review an online game, the concept of gaining knowledge is similar as traders need to know how trading works. Because the exotic currency pairs lack sufficient liquidity, at least compared to that of other pairs, the accuracy of technical analysis can suffer.

- Among different Forex pairs categories, as we have already said, the most popular ones are the major currency pairs.

- 78% of retail investor accounts lose money when trading CFDs with this provider.

- However, the country’s significant agricultural presence is what attracts the “commodity currency” label.

- No matter what forex trading platform or broker that you use, you will be exposed to various different types of forex trading charts.

However, the case is different for the forex market due to currency pairing. Merely put, whenever traders initiate a trade, they are concurrently buying and selling the pair. For instance, when buying the EUR/USD , a trader buys the USD and sells the Euro concurrently. Equally, if buying the EUR/USD , one sells the US dollar and buys the Euro simultaneously. Forex quotes reflect the price of different currencies at any point in time. Since a trader’s profit or loss is determined by movements in price , it is essential to develop a sound understanding of how to read currency pairs.

Understanding Forex Quote Basics

He has a background in management consulting, database administration, and website planning. Today, he is the owner and lead developer of development agency JSWeb Solutions, which provides custom web design and web hosting for small businesses and professionals. The price at which you buy , represents how much of the quote currency you need to get one unit of the base currency.

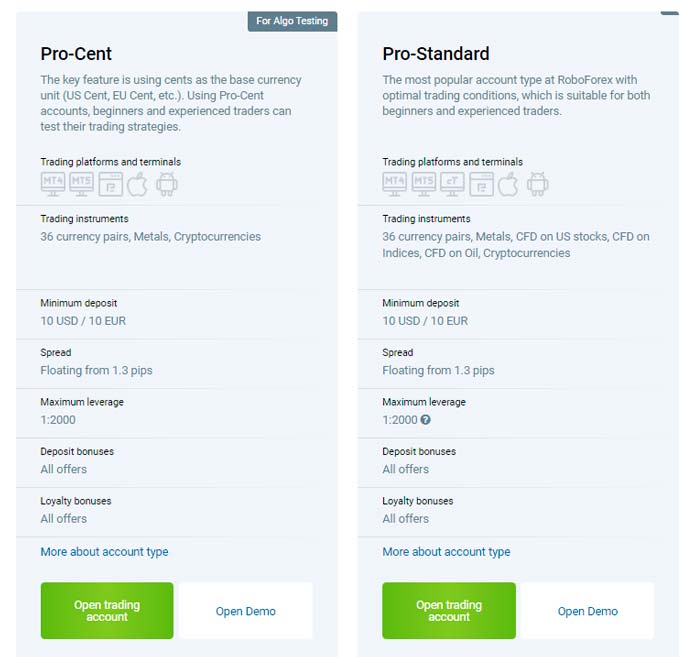

The price to buy a currency will typically be more than the price to sell the currency. This difference is called the spread and is where the broker earns money for executing the trade. Spreads tend to be tighter for major currency pairs due to their high trading volume and liquidity. The EUR/USD is the most widely traded currency pair, so it is no surprise that the spread in this example is 0.6 pips.

Forex quotes show two currencies, the base currency, which appears first and the quote or variable currency, which appears last. The price of the first currency is always reflected in units of the second currency. Sticking with the earlier EUR/USD example, it is clear to see that one Euro will cost one dollar, 14 cents and 04 pips.

In our example, if the Euro were to strengthen while the US dollar remained static, the EURUSD would rise. Conversely, if the Euro weakened the pair would fall, all things being equal. Using EURUSD as an example, the Euro would be the base currency.

Knowing how to read them is perhaps first skill you must have, before entering the market. Fundamental analysis involves analyzing a country’s economic data and upcoming catalysts that could change lead to price changes. Therefore, a person should look at strong fundamentals as a positive factor in the value of a currency. Difference Between The Bid And Ask PriceThe bid rate is the highest rate the prospective buyer is ready to pay for purchasing the security. In contrast, the ask rate is the lowest rate, the prospective seller of the stock is ready to sell the security. Bid PriceBid Price is the highest amount that a buyer quotes against the “ask price” to buy particular security, stock, or any financial instrument.

The code typically consists of the first two letters representing the country, and the third being the actual currency. So, for example, the U.S. dollar is represented as USD, and the Euro is represented as EUR. The amount of time shown on the chart depends on the particular timeframe you select.

Generally, the US dollar comes first in a pair, with the notable exception of when it is quoted against the Euro or the British pound. The lowest point of the bar will, conversely, show the lowest price reached by that pair during the same day. As for alt-coins and tokens this list may be different depending on who you ask but the way I’ve always defined them as is simply any coin other than Bitcoin.

Analyzing Market While Trading Forex

One of the biggest reasons why major currency pairs are so popular is their liquidity. Because of high liquidity, major currency pairs can be traded in larger volumes. As for the currency itself, the most traded one is the US dollar. A forex quote always consists of two currencies, a currency pair consisting of a base currency and a quote currency (sometimes called the “counter currency”). The first part of the pair is called the base currency, and the second is called the quote currency.

We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. The quote is in five decimal places here, but some brokers use four decimal places. But all the pairs containing JPY, for instance, have two or three decimal places, alpari review depending on the broker. Virtual CurrencyVirtual currency is a type of digital currency representing the value in a digital format, and it is active in the virtual community. In most countries, people can use VC as a medium of exchange, but it does not enjoy a legal tender status.

Cross Currency Pairs (A.K.A Minors)

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. EURUSD, USDJPY, GBPUSD, USDCHF, USDCAD, AUDUSD, and NZDUSD are all majors. Majors are widely traded by beginners and professionals alike.

Bids and Ask Prices

Between 74-89% of retail investor accounts lose money when trading CFDs with this provider. 73.9% of retail investor accounts lose money when trading CFDs with this provider. 71% of retail investor accounts lose money when trading CFDs with this provider. 78% of retail investor accounts lose money when trading CFDs with this provider. If the central bank decides to increase the interest rates, the demand for the currency is also increased.

British Pound Crosses

Forex traders have developed several types of forex charts to help depict trading data. It comprises mostly of the currencies of the emerging and developing economies. While trading Forex, people are using different types of technical and fundamental analysis. No matter which Forex pairs categories you are using for trading, you will have to use analytical tools to make sure that you are doing the right thing. Trading is a skill that takes some time to master, for it to be successful, you will have o work on your patience, discipline, and you should also have an interest in this market.

For example, if you sell two negatively correlated pairs, chances are only one of the two trades will be successful. Remember that the foreign exchange market is the most liquid financial market in the world, so even some of velocity trade the less popular currencies are extremely liquid. This is one reason why I’m not an advocate of mastering one or two currency pairs at a time. In fact, making this mistake can quickly lead to forcing trades and overtrading.