The primary components of the income statement include revenues, cost of goods sold, gross profit, operating expenses, and net income. This new trial balance is called an adjusted trial balance, and one of its purposes is to prove that all of your ledger’s credits and debits balance after all adjustments. Missing transaction adjustments help you account for the financial transactions you forgot about while bookkeeping—things like business purchases on your personal credit. In other words, deferrals remove transactions that do not belong to the period you’re creating a financial statement for. Journal entries are usually posted to the ledger as soon as business transactions occur to ensure that the company’s books are always up to date.

Income Statement

The statement of cash flows shows the cash inflows and outflows for a company over a period of time. The balance sheet, lists the company’s assets, liabilities, and equity (including dollar amounts) as of a specific moment in time. That specific moment is the close of business on the date of the balance sheet. Notice how the heading of the balance sheet differs from the headings on the income statement and statement of retained earnings. A balance sheet is like a photograph; it captures the financial position of a company at a particular point in time. As you study about the assets, liabilities, and stockholders’ equity contained in a balance sheet, you will understand why this financial statement provides information about the solvency of the business.

Vertical and Horizontal Analysis

- Once you’ve created an adjusted trial balance, assembling financial statements is a fairly straightforward task.

- However, the loss is only realized when the company sells that asset.

- This new trial balance is called an adjusted trial balance, and one of its purposes is to prove that all of your ledger’s credits and debits balance after all adjustments.

- As you can see all four general-purpose financial statements are prepared and presented here.

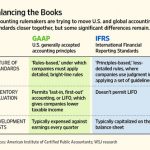

IFRS is a set of accounting standards developed by the International Accounting Standards Board (IASB) for use in over 140 countries. IFRS aims to harmonize accounting practices globally and enhance the comparability of financial statements. There is more technical information about how to prepare financial statements in the next section of my accounting best accounting software and invoice generators of 2021 course. Here is an example of Paul’s Guitar Shop, Inc.’s financial statements based on his adjusted trial balance in our previous example. Now that you know all about the four basic financial statements, read on to learn what financial statement is prepared first.

Step 3: Accrue Unpaid Wages

If a company has subsidiaries or other related entities, it may need to prepare consolidated financial statements. After gathering financial data, accountants must adjust and classify transactions according to the appropriate accounting principles and standards. For example, if a business sells $25,000 worth of product over the year, the sales revenue ledger will have a $25,000 credit in it. This credit needs to be offset with a $25,000 debit to make the balance zero. When transitioning over to the next accounting period, it’s time to close the books. For instance, banks often want basic financials to verify the a company can pay its debts, while the SEC required audited financial statements from all public companies.

Prepare your cash flow statement last because it takes information from all of your other financial statements. Use the information from your income statement and retained earnings statement to help create your balance sheet. The process of preparing a cash flow statement depends on whether you’re using the direct or indirect method. This statement simply lists the balances of your accounts, which you would have calculated before preparing your trial balance. The net income calculated at the end of the income statement is added to retained earnings, which is required to complete the statement of changes in equity.

According to the rules of double-entry accounting, all of a company’s credits must equal the total debits. If the sum of the debit balances in a trial balance doesn’t equal the sum of the credit balances, that means there’s been an error in either the recording or posting of journal entries. The first step to preparing an unadjusted trial balance is to sum up the total credits and debits in each of your company’s accounts.

Net income is either retained by the firm for growth or paid out as dividends to the firm’s owners and investors, depending on the company’s dividend policy. Finally, ethical considerations such as integrity, objectivity, confidentiality, professional competence, and due diligence must be taken into account to ensure accurate financial statement preparation. They must provide unbiased, accurate, and operating expenses: definition and example complete information in the financial statements to protect the interests of all stakeholders. Conservatism is an accounting principle that requires accountants to exercise caution when making judgments and estimates. It suggests that, when in doubt, accountants should choose the option that will least overstate assets and income and least understate liabilities and expenses. After preparing the individual components and consolidating financial statements (if applicable), the final step is to review and finalize the financial statements.

It’s not the flashiest part of running purpose of an iolta checking account for a lawyer a small business, but analyzing the financial data from your small business on a regular basis is vital to the health of your company. Maintaining the proper financial statements helps you determine your business’ financial position at a specific point in time and over a specified period. This process ensures that all information is accurate, complete, and compliant with the relevant accounting standards. Once finalized, the financial statements are presented to the company’s management, board of directors, and other stakeholders.